Legal Services NYC has agreed to the Legal Services Staff Association’s request to improve the employee retirement plan by adding more low-fee index funds to the portfolio of mutual funds.

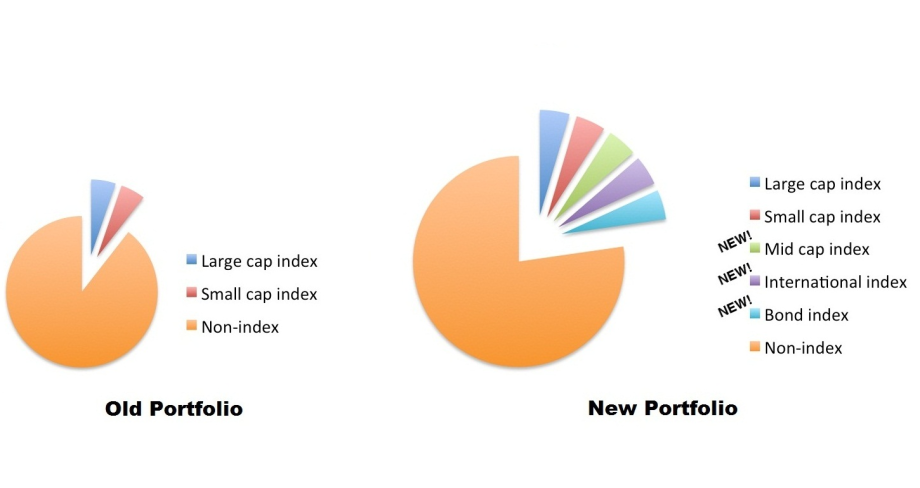

Before this change, the LSNYC 403(b) retirement portfolio included only 2 index funds out of the 19 options. The union pressed LSNYC to expand these options to ensure that employees would have at least one index fund option in each major investment category. Following discussions in the union-management retirement plan committee, LSNYC agreed to the union’s request.

Beginning on December 10, 2013, LSNYC employees will be able to select an index fund option in each of the following major mutual fund categories:

- Large Cap Funds (funds made up of very large and established companies)

- Mid Cap Funds (funds made up of mid-sized companies)

- Small Cap Funds (funds made up of newer and/or smaller companies)

- International Funds

- Bonds

The Legal Services union applauds LSNYC management for taking this significant step to improve the retirement plan. Unlike many municipal employees, LSNYC staff do not have a pension, so we cannot count on having a guaranteed or predictable income stream when we retire. Instead, we must do our best to invest wisely from among the handful of mutual funds offered to us as we try to save money for retirement.

Challenges remain: the average fee charged to LSNYC staff by retirement plan administrator VALIC (formerly AIG) is .81%. This means that over ten years, an employee who has $50,000 invested will pay over $4,000 in fees to VALIC. Over an employee’s lifetime, money lost in fees compounds greatly: the New York Times has reported that the extra costs associated with high fee retirement funds can easily cost investors over $100,000 by the time they retire. Although the union has repeatedly raised this and other concerns with LSNYC management, LSNYC in 2012 chose to renew its contract with VALIC without consultation with the union.

The Legal Services union encourages management to continue taking steps to protect and preserve its employees’ fiscal futures. Our comparatively low salaries make it even more important that we are able to save for retirement, and that our retirement investments are not eaten away by high fees paid to an investment corporation.

Frequently Asked Questions

What is a mutual fund?

What is an index fund?

Active versus index funds

How do I make changes to my portfolio?

Learn More

Graphic: Sarah Bray