The Decisions Team is responsible for approving or denying applications for Hardship Funds. If an application is approved they determine how much money is given to an applicant based on the decision process outlined below. For the purpose of reviewing and making decisions about applications the Decisions Team is divided into smaller groups of 3-4 members. The Processing Team assigns each application to one of these smaller groups to ensure that no one on the Decisions Team receives their own application.

Organization

- The Decisions Team has twelve team members.

- For review and decision making the team is divided into four teams of three.

Schedule

- The Decisions Team met on Mondays and Tuesdays to make decisions.

- Monday – 3-4 hours

- Tuesday – 3-4 hours (sometimes shorter, depending on the amount of applications left).

- Due to the high volume of applications submitted during the first week after the strike the Decisions Team met several other times to review and decide applications. Participation was not as high for these meetings, so decisions were made in teams of two.

Decision Process

[spacer size=”10″]STEP 1: Review Application

- Look at applicant’s account balances.

- See whether savings/liquid assets exceed the Protected level.

- $3000 per member + $1000 for each dependent.

- Stocks or other assets with a tax withdrawal penalty are discounted by 1/3.

- 403(b) accounts are not counted as available assets. If applicable, calculate the amount of the savings spend-down.

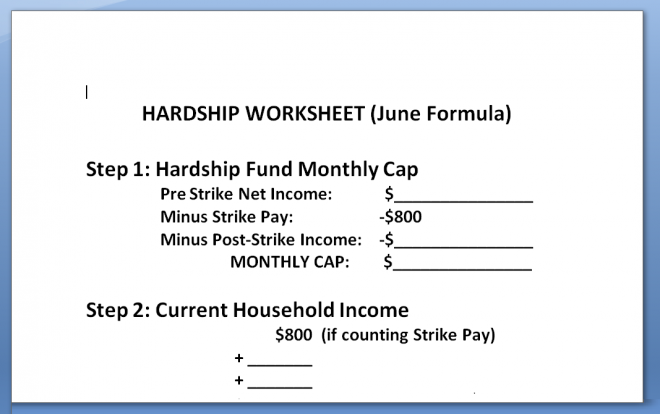

STEP 2: Calculate Monthly Cap

- Pre-strike net income with 403(b) loan payments added back in.

- Subtract any countable income from member (e.g. strike pay, portion of paychecks for post-strike hardships, income from temp work during strike).

- EXCEPTION TO CAP: Exception to the cap was allowed for necessary dental expenses, provided that the member utilized Guardian COBRA if doing so would reduce expenses (i.e. if they weren’t already over the yearly benefit max).

STEP 3: Review Listed Expenses

- Determine whether expenses are high-priority or low-priority using the Monthly Expenses Prioritization Table.

STEP 4: Calculate Deficit Between High-priority Expenses and Household Income

- Household income = income from other household members, non-LSNYC income sources, strike pay if we are counting, etc.

STEP 5: Calculate Hardship Award

- If deficit minus savings spend-down (if any) is more than the monthly cap, award is limited to the cap. Otherwise, award = deficit minus savings spend-down (if any).

- If no deficit, or if savings spend-down is greater than the deficit, no award.

- PRE-STRIKE ARREARS: In accordance with a vote by the membership, we recommended that the EC approve non-forgivable loans for pre-strike rent and utility arrears.

STEP 6: Decision

- Fill out worksheet and decision letter.

- Give decision letter to Processing Team or place in appropriate drawer.

Materials

Hardship Worksheet

- One-page worksheet

- Used to organize application information

- Includes monthly cap and deficit

- Wasn’t distributed to applicants, but proved useful to keep on file for future reference

Download Hardship Worksheet

[spacer size=”1″]Spreadsheets with formulas

[spacer size=”10″]- Extremely helpful tool

- Used to calculate savings spend-down, cap, and deficit

- Important to have computer present at Decisions Team meetings to access spreadsheets

- Three sheets with three different formulas:

Decision Letters

- Standard letters that were delivered to the Processing Team to be given to applicants

- Breaks down decision reason

- Itemizes high-priority and low-priority expenses

[document url=”https://lssa2320.org/wp-content/uploads/2015/10/Hardship-Decision-Ltr-Approval.docx” width=”200″ height=”200″]

[document url=”https://lssa2320.org/wp-content/uploads/2015/10/Hardship-Decision-Ltr-Denial.docx” width=”200″ height=”200″]